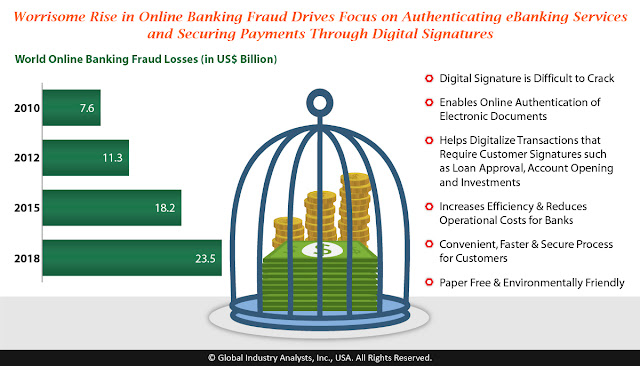

The global market for Digital Signature is projected to reach US$8.2 billion by 2025, driven by the growing real-world losses of financial fraud against the backdrop of an increasingly digital world; and implementation of regulations that recognize the legality of digital signatures. Factors driving digitalization of the banking and payments sector include increased use of smart devices like smartphones and tablets for financial transactions; development of payment gateways and expansion of the app ecosystem surrounding digital payments. However, authentication and security remain prime areas of concern, making customer trust the subtle but real driver of digital commerce and banking. As businesses undergo digital transformation, especially banks and financial institutions, in their front and back office operations, they are increasingly acknowledging the link between customer recognition, convenience, trust and fraud risk. A large portion of customers’ trust today emerges from the confidence in the security measures undertaken by companies for digital transactions. This creates strong commercial opportunities for seamless security technologies that have little or no impact on the digital customer experience. Poised to gain under this scenario is “Digital Signature” defined as a complex mathematical process that validates the document and the sender. The technology is suitable for digital financial documents, legal documents, and copyright content and material. Benefits of digital signature driving its adoption include added security; helps validate origin, identity and status of an electronic document; based on public key cryptography it is difficult to crack; reduced costs as need for paper and printing is eliminated; saves time on document authentication; enables hassle free electronic document management; increase in efficiency and reduced operational costs for banks; and convenient, faster and secure process for customers. Read More…

The global market for Digital Signature is projected to reach US$8.2 billion by 2025, driven by the growing real-world losses of financial fraud against the backdrop of an increasingly digital world; and implementation of regulations that recognize the legality of digital signatures. Factors driving digitalization of the banking and payments sector include increased use of smart devices like smartphones and tablets for financial transactions; development of payment gateways and expansion of the app ecosystem surrounding digital payments. However, authentication and security remain prime areas of concern, making customer trust the subtle but real driver of digital commerce and banking. As businesses undergo digital transformation, especially banks and financial institutions, in their front and back office operations, they are increasingly acknowledging the link between customer recognition, convenience, trust and fraud risk. A large portion of customers’ trust today emerges from the confidence in the security measures undertaken by companies for digital transactions. This creates strong commercial opportunities for seamless security technologies that have little or no impact on the digital customer experience. Poised to gain under this scenario is “Digital Signature” defined as a complex mathematical process that validates the document and the sender. The technology is suitable for digital financial documents, legal documents, and copyright content and material. Benefits of digital signature driving its adoption include added security; helps validate origin, identity and status of an electronic document; based on public key cryptography it is difficult to crack; reduced costs as need for paper and printing is eliminated; saves time on document authentication; enables hassle free electronic document management; increase in efficiency and reduced operational costs for banks; and convenient, faster and secure process for customers. Read More…

Comments

Post a Comment